tax refund calculator ontario 2022

You have to give a reasonable estimate. Health insurance contributions range from 0 to 900 depending on your income.

Will I Get A Tax Refund This Year What To Expect For Tax Refunds In 2022 2022 Turbotax Canada Tips

Get started Employment income Self-employment income RRSP deduction.

. For a family of four total annual CAI payments for 2022-23 will be as follows. Reflects known rates as. 2022 free Canada income tax calculator to quickly estimate your provincial taxes.

W-4 Adjust - Create A W-4 Tax Return based. Start with a free eFile account and file federal and state taxes online by April 18 2022. Taxable Income Calculate These calculations do not include non-refundable tax credits other than the basic personal tax credit.

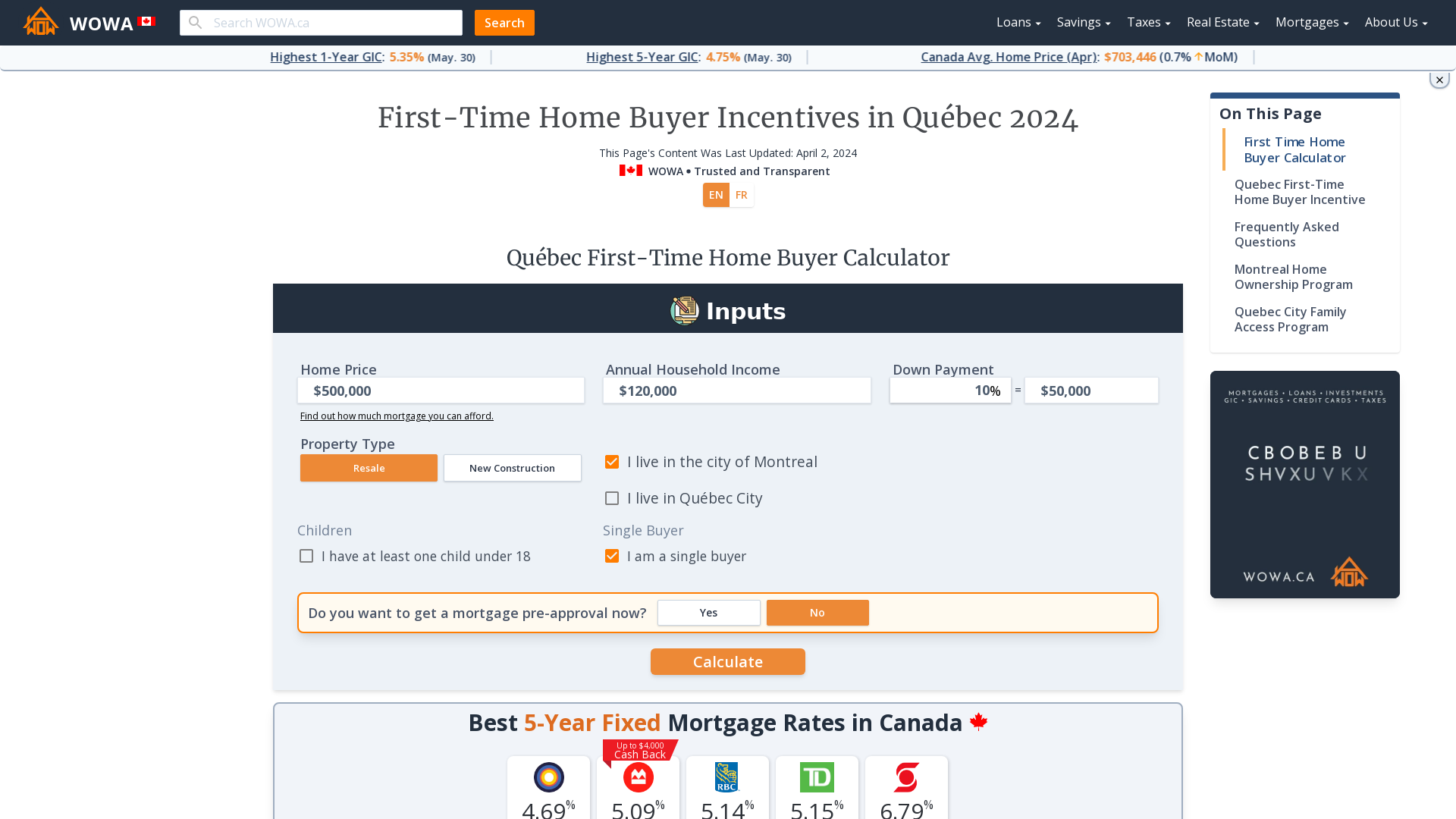

If your tax situation changes you can always come back to the calculator again. The maximum tax refund is 4000 as the property is over 368000. Amounts earned up to 46226 are taxed at.

The Ontario land transfer tax for a home purchased for 500000 in Ottawa is 6475. There is also a surtax between 0 and 36 on net provincial tax. The period reference is from january 1st 2022 to december 31 2022.

This calculator is for 2022 Tax Returns due in 2023. Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns no later than July 15 2022. The parent will receive no tax refund.

This is your refund or balance owing If the result is negative you have a refund. Your average tax rate is 270 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate. Income tax calculator for Ontario 2022 Calculate the total income taxes of the Ontario residents for 2022 This calculator will help you get the net tax income after tax the percentage of tax of each government provincial and federal and all the contributions CPP and EI.

However the child will only receive 50 of this amount or 2000. Calculations are based on rates known as of March 29 2022 and includes changes from the New Brunswick 2022 budget. 5 rows The 2022 Tax Year in Ontario runs from January 2022 to December 2022 with individual tax.

Step 1 Run Your Numbers in the Tax Refund CalculatorEstimator. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month. This way you can report the correct amounts received and avoid potential delays to.

These are your total credits. TurboTax Free customers are entitled to a payment of 999. For 2021 the non-refundable basic personal amount in Ontario is 10880 along with an extra tax reduction amount that Ontario provides to its residents.

File your tax return today Your maximum refund is guaranteed. Heres what you need to know. If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software.

5 rows The tax rates for Ontario in 2022 are as follows. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Use our simple 2021 income tax calculator for an idea of what your return will look like this year.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043That means that your net pay will be 37957 per year or 3163 per month. Youll get a rough estimate of how much youll get back or what youll owe. Family Member Ontario Manitoba Saskatchewan Alberta.

2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory. 2022 RRSP savings calculator. 476 Provincial or territorial credits attach for 479 if it applies 479 Add lines 437 to 479.

RATEucator - Income Brackets Rates. File your taxes the way you want. Stop by an office to drop off your documents with a Tax Expert.

2021 2022 tax brackets and most tax credits have been verified to Canada Revenue Agency and. 2022 Tax Calculator Estimator - W-4-Pro. Calculate the tax savings your RRSP contribution generates in each province and territory.

Childrens fitness tax credit. We strive for accuracy but cannot guarantee it. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022.

W-4 Pro Select Tax Year 2022. PAYucator - Paycheck W-4 Calculator. As you answer the questions you will see that the information you enter.

You dont have to be 100 exact. The calculator reflects known rates as of January 15 2022. 482 -Line 435 minus line 482.

X 15 459 Tax paid by instalments. The total Ontario land transfer tax would be 6475 - 2000 4475. Your average tax rate is 270 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate.

Meet with a Tax Expert to discuss and file your return in person. If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. Answer the simple questions the calculator asks.

Turbotax Premier Download 2021 Turbotax Canada

How Can I See A Detailed Summary Of My Return In Turbotax Online

Will I Get A Tax Refund This Year What To Expect For Tax Refunds In 2022 2022 Turbotax Canada Tips

How Much Tax Would I Pay On An Annual Salary Of 80 000 In Ontario Canada Quora

7 Best Free Tax Return Software For Canadians 2022 Savvy New Canadians

2022 Tax Day Is Here What Happens If You Miss The Deadline Here S What To Know Nbc Chicago

The Biggest Life Insurance Companies In Canada 2022 Full List

The 7 Best Free Tax Return Software For Canadians In 2022 Filing Taxes

Purchasing A Property How Much Tax Is Involved Kalfa Law

2022 Public Service Pay Calendar Canada Ca

2022 Public Service Pay Calendar Canada Ca

How Does Covid 19 Affect Your 2021 Personal Income Tax Filing

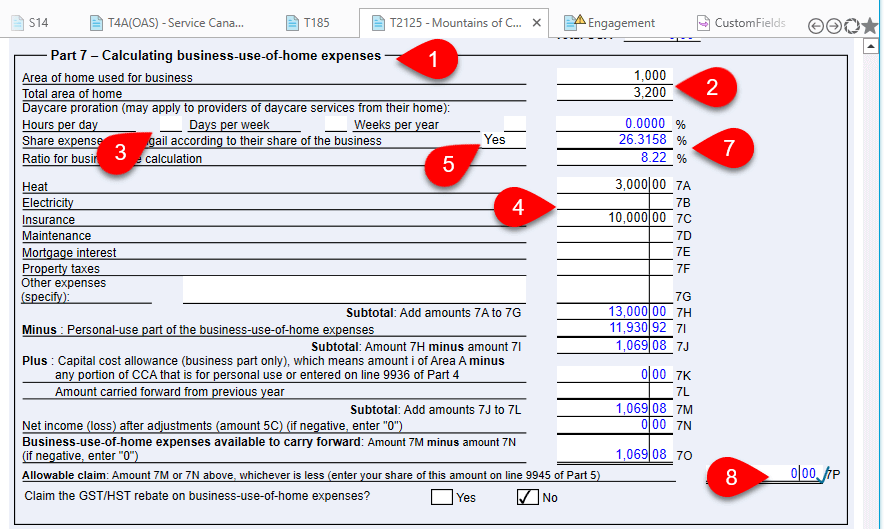

Self Employment Income T2125 Taxcycle

How Is Rental Income Taxed By A Ccpc Madan Ca

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

The 7 Best Free Tax Return Software For Canadians In 2022 Filing Taxes